Articles & Insights

Factors shaping the state of South African agriculture

Factors shaping the state of South African agriculture

Various factors, both positive and negative, continue to shape South Africa’s agricultural sector. Starting on a positive note, early indicators suggest a strong likelihood of favourable rainfall conditions across South Africa for the upcoming 2025/26 summer season. Current forecasts indicate a neutral weather phase with average rainfall, which would be generally favourable. Yet the occurrence of La Niña rains remains a possibility, which would further ease concerns about a potential shift from the wet 2024/25 La Niña season to a drier El Niño pattern.

Summer grains and oilseeds

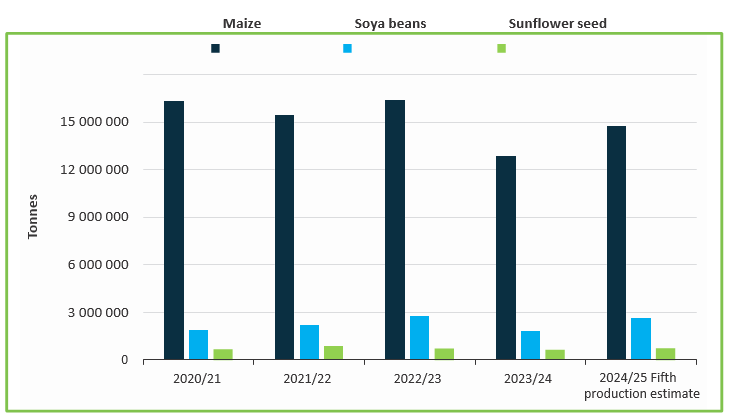

South African producers are likely to begin evaluating the prospects for the 2025/26 summer crop season more seriously by October, once planting gets underway. For now, the focus remains on the ongoing harvest of summer grains, oilseeds, citrus, and other crops.

The summer crop harvest is progressing well, with oilseed harvesting nearly complete. Encouragingly, feedback suggests crop quality – particularly in soya bean regions – is better than initially feared. In contrast, the maize harvest is lagging its usual schedule due to delayed plantings and persistent rains through April, which slowed crop development. Current deliveries to commercial silos raise concerns about the quality of white maize, although yellow maize appears to be less affected.

While quality issues may impact producer margins, they do not pose a risk to consumers from a food supply perspective. South Africa’s overall grain supply remains stable. With current production levels and commodity prices, we anticipate a supportive environment for moderating food price inflation in the second half of 2025.

We continue to closely monitor winter crop conditions in the Western Cape, which has received excellent rainfall so far. The primary crops cultivated during this season include wheat, barley, canola, and oats. The province remains a key focus area for South Africa’s winter crops, as it accounts for more than two-thirds of national production.Overall, crop conditions in the Western Cape are generally favourable. However, in someareas, producers faced significantly higher input costs due to a snail infestation affecting canola. Despite this, they appear to be managing the situation effectively. In other provinces, winter crops are benefiting from elevated dam levels, thanks to the abundant rainfall during the extended 2025 summer season.Export diversification The idea of diversifying export markets has gained attention, but remains a long- term endeavour rather than an immediate solution. Businesses cannot simply shift to new markets overnight – significant market development efforts are required.

Meanwhile, countries such as China and India continue to pose challenges for South African agricultural exports, including high tariffs and stringent phytosanitary regulations which persist despite China’s recent statements indicating a willingness to lower tariffs on products from Africa.

As a result, continued engagement with the United States remains essential for South Africa, even as it explores new export opportunities. Diversification should be seen as complementary to, rather than a replacement for, the American market.

Logistics

Port logistics have been less challenging than in previous years. The ongoing collaboration between Transnet, businesses, and government is contributing to better planning and operations, resulting in improved service to the sector.

However, we are still far from reaching the desired level of efficiency, and further progress will require increased investment.

Biosecurity issues

Beyond trade and harvest dynamics, biosecurity remains a challenge. Foot- and-mouth disease continues to impose growing costs on businesses. The recent vaccination campaign marks an important step towards resolving the current crisis and is effectively managed through collaboration between government and the private sector.

The next critical priority is to rebuild domestic vaccine manufacturing capacity. There is also an urgent need to streamline the registration of new vaccines, as the pace of outbreaks continues to accelerate. One sector that will remain under increasing scrutiny is the poultry industry, particularly regarding avian influenza.

Cautious optimism

The 2024/25 harvest for various field crops appears promising, with ample yields anticipated. The 2025/26 season also shows potential to support continued growth. However, there must be no complacency regarding animal and plant diseases, which continue to pose serious risks to South Africa’s agricultural growth and export potential.

For more information, send

an email to wandile@agbiz.co.za or visit www.agbiz.co.za